Hanseatic sustainability strategy

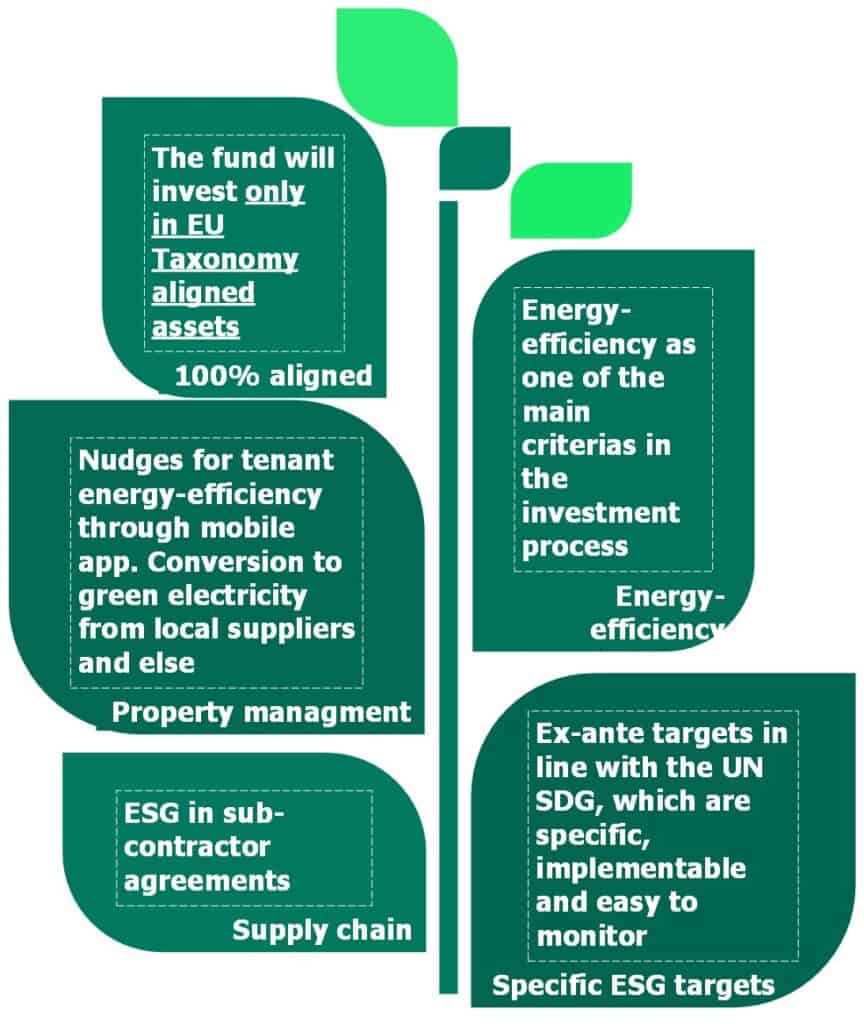

EU Taxonomy

– Hanseatic fund invests 100% in residential real estate assets (apartments) with a high energy efficiency aligned with the EU Taxonomy for sustainable finance (EU 2020/852)

ESG

– Fund investment activities are classified as economic activities that can make a substantial contribution to climate change mitigation

– Fund fulfills EU “Do no significant harm” (DNSH) requirements

– SFDR Article 8 compliant

Implementation of United Nations Sustainable Development Goals

To realize our goals, we have established clear, quantifiable objectives. These objectives are designed to support three specific UN Sustainable Development Goals and their associated targets. Key contributions include:

SDG 7: Promoting clean and affordable energy.

SDG 11: Supporting sustainable urban development.

SDG 13: Reducing CO2 emissions to combat climate change.

- The objective is to move the residential buildings further onto a more sustainable trajectory

- A framework that sets ex-ante targets in line with the UN Sustainable Development Goals, which are specific, implementable and easy to monitor

- Improve the attractiveness and the value of the properties as they become future-proof

- Improve the social aspect of the shortage of rental apartments, through increased housing availability

Benefits of sustainable investments

Sustainability is reshaping the real estate industry, transforming our perception of residential properties. Sustainable Residential Real Estate Funds offer investors key advantages, including energy efficiency, increased property value, higher investment returns, and reduced financing costs through sustainable finance initiatives.

Energy Efficiency: Green and Cost-Effective

- Energy-efficient practices reduce operational costs and attract budget-conscious tenants.

- Energy-efficient buildings enjoy heightened market appeal and deliver strong long-term investment performance.

Increased Property Value: Investing in a Sustainable Future

- Properties with sustainability features, such as solar panels and efficient insulation, command higher prices in a market driven by sustainable living.

- Sustainable residential real estate capitalizes on future-oriented market trends, maximizing financial rewards.

European Union Sustainability Regulations: Shaping the Industry

- The EU’s commitment to emissions reduction and energy efficiency drives sustainability in real estate. EU Taxonomy Regulation establishes criteria for environmental sustainability, enhancing transparency and credibility.

- EU Taxonomy compliance ensures alignment with sustainability standards and access to sustainable finance initiatives like green bonds and sustainability-linked financing, which reduce financing costs.

Higher Investment Returns: Merging Sustainability and Financial Success

- Sustainable investments deliver competitive returns, with improved long-term financial performance and reduced risk exposure.

- Integrating sustainability considerations, makes buildings future proof, which provides stability for investors.

Learn more about investing in Hanseatic funds