Navigating Risk in Real Estate Investment FUNDs

At Hanseatic, we understand that successful real estate investment requires a deep understanding of risk. Each property type and investment strategy comes with its unique set of risks and challenges. In this comprehensive guide, we delve into the different property types and investment strategies within real estate funds, providing a detailed analysis of their risk aspects.

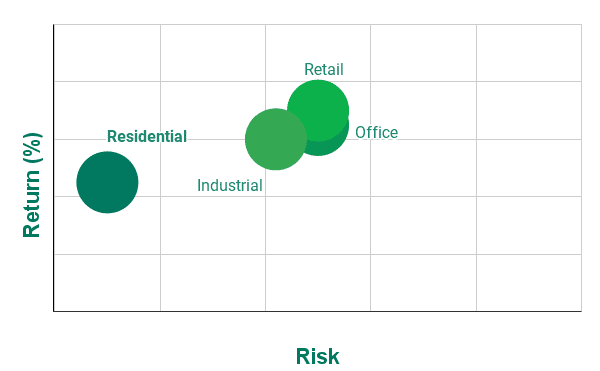

Understanding Risk in Different Property Types

Real estate investment funds vary in risk depending on the type of property. Here’s a detailed look at each category:

Residential Real Estate:

- Risk Level: Generally considered the lowest among real estate investments.

- Characteristics: These investments focus on properties such as apartments and apartment buildings, which typically experience stable and consistent rental demand. The demand for housing tends to be less sensitive to economic downturns, offering a more predictable and stable income stream.

- Suitability: Ideal for investors seeking a reliable investment with lower volatility, especially those new to real estate investing or with a conservative risk appetite.

Office and Retail Real Estate:

- Risk Level: Medium to high, reflecting their higher sensitivity to economic cycles.

- Characteristics: Office real estate includes corporate buildings and business parks, while retail encompasses shopping centers and storefronts. Both sectors are influenced by factors such as employment rates, corporate health, consumer confidence, and spending patterns. Economic downturns or shifts in business and consumer behavior can significantly impact occupancy rates and rental yields.

- Suitability: Best for investors who are comfortable with economic fluctuations and have a medium to long-term investment horizon.

Industrial Real Estate:

- Risk Level: Medium to high, due to exposure to broader economic and global trade trends.

- Characteristics: This category includes investments in warehouses, distribution centers, and manufacturing facilities. The performance of these properties can be influenced by various factors, including global trade dynamics, economic health, and industrial demand.

- Suitability: Ideal for investors who understand the industrial sector and are prepared to handle the potential volatility associated with global economic conditions.

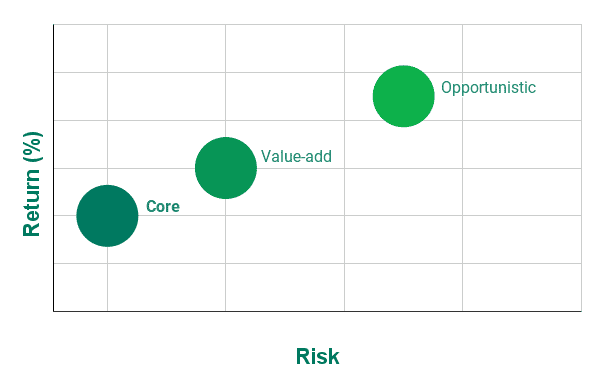

Exploring Investment Strategies and Their Risks

Core Strategy:

- Risk Profile: Low

- Overview: Core investments are typically focused on already built well-located, high-quality properties with strong occupancy rates and reputable tenants. The strategy is centered around generating stable, reliable income with minimal development or refurbishment needs.

- Investor Fit: This approach is particularly appealing to conservative investors who prioritize capital preservation and stable income over high-risk, high-return ventures.

Value-Add Strategy:

- Risk Profile: Medium to high

- Overview: Value-add investments involve properties that require enhancement or repositioning to improve their value and potential returns. This strategy demands active management, including property upgrades, improved operational efficiencies, or rebranding efforts.

- Investor Fit: Suited for investors who are willing to engage in more hands-on investment management and can tolerate higher risk for the potential of increased returns.

Opportunistic Strategies:

- Risk Profile: Highest among real estate strategies

- Overview: This approach targets significant returns through investments in high-risk opportunities, such as properties needing extensive redevelopment, distressed assets, or greenfield construction projects.

- Investor Fit: Designed for sophisticated investors with a high-risk tolerance, long-term perspective, and the capacity to invest substantial resources.

Conclusion

At Hanseatic, our commitment is to provide a clear understanding of the varying risks associated with different real estate investments. For further guidance on navigating the risks in real estate investment funds, we invite you to contact us for expert advice and support.